how much is virginia inheritance tax

Virginia does not collect Inheritance Tax. This chapter shall be known and may be cited as the Virginia Estate Tax Act Code 1950 58-2381.

Where S My Kentucky State Tax Refund Taxact Blog Tax Refund State Tax Kentucky State

Virginia Estate Tax 581-900.

. If the estate is appraised for up to 1 million more than that threshold the estate tax can be in excess of 345000. With the elimination of the federal credit the Virginia estate tax was effectively repealed. You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only imposes the tax on inheritances over 50000.

The tax rate begins at 18 percent on the first 10000 in taxable transfers over the 117 million limit and reaches 40 percent on taxable transfers over 1. Virginia taxes capital gains at the same income tax rate up to 575. Virginia currently does not levy an inheritance tax.

Advertisement House Bill 5018 The Virginia inheritance tax was abolished with the passage of House Bill 5018. Heres how estate and inheritance taxes would work. Rates and tax laws can change from one year to the next.

2193 million Washington DC District of Columbia. Inheritances that fall below these exemption amounts arent subject to the tax. The top estate tax rate is 20 percent exemption threshold.

If you were the decedents parent grandparent sibling child other lineal descendant or the spouse of one of those people the first 40000 you inherit is exempt but the value of your inheritance above 40000 is taxed at 1. For example if an individuals estate at death is worth 7250000 then under ATRA 5250000 is excluded from the Federal Estate Tax and the remaining 2000000 is taxed at a top tax rate of 40. You would receive 950000.

You would pay 95000 10 in inheritance taxes. While other local jurisdictions have an exemption that is lower Virginia does not. Inheritance and Estate Tax and Inheritance and Estate Tax Exemption Virginia.

Heres a breakdown of each states inheritance tax rate ranges. No estate tax or inheritance tax. Virginia does not have an inheritance tax.

Distant family and unrelated heirs pay between 10 and 15 percent of the value of the inheritance. There is no federal inheritance tax but there is a federal estate tax. Prior to July 1 2007 Virginia had an estate tax that was equal to the federal credit for state death taxes.

In 2021 federal estate tax generally applies to assets over 117 million. The tax rate varies depending on the relationship of the heir to the decedent. How Much Is the Inheritance Tax.

Up to 1158 million can pass to heirs without any federal estate tax although exemption amounts on state estate taxes in certain states are considerably lower and can apply even when the federal. Virginia taxpayers are likely to get some money back later this year. Today Virginia no longer has an estate tax or inheritance tax.

The tax rate begins at 18 percent on the first 10000 in taxable transfers over the 117 million limit and reaches 40 percent on taxable transfers over 1 million according to an. Today Virginia no longer has an estate tax or inheritance tax. An inheritance or estate tax is a tax levied on the assets of an individual at the time of his death with a higher tax rate typically charged on larger estates.

Whereby this Commonwealth is given reasonable assurance of the collection of its inheritance or death taxes interest and penalties from the estates of decedents dying. Price at Jenkins Fenstermaker PLLC by calling 866 617-4736 or by completing our firms Contact form. The estate would pay 50000 5 in estate taxes.

The top estate tax rate is 16 percent exemption threshold. If the estate is worth more than 5250000 then the amount over that 5250000 is taxed at a top tax rate of 40 for the Federal Estate Tax. Iowa for instance doesnt impose an inheritance tax on beneficiaries of estates valued at 25000 or less.

Any estate worth more than 118 million is subject to estate tax and the amount taken out goes on a sliding scale depending on how much more than 118 million the estate is worth. I would be happy to help you manage the tax issues presented by an inheritance. For example Indiana once had an inheritance tax but.

An inheritance or estate tax is a tax levied on the assets of an individual at the time of his death with a higher tax rate typically charged on larger estates. Virginia currently does not have an independent estate tax that is lower than the federal exemption. The top estate tax rate is 20 percent exemption threshold.

The federal estate tax exemption is 5450000 for decedents dying in 2016. Virginia does not have an inheritance tax. The top estate tax rate is 16 percent exemption threshold.

If you are considering your estate plan or have recently received an inheritance and need more information contact me Anna M. States may also have their own estate tax.

Virginia Dpb Frequently Asked Questions

Pin By Toni Phillips Mackain Bremner On Relocation Reirement In 2022 Beach Communities Folly Beach South Carolina Island Lighthouse

Virginia State Taxes 2022 Tax Season Forbes Advisor

West Virginia Tax Forms 2019 Printable State Wv It 140 Form And Wv It 140 Instructions Tax Forms West Virginia Tax

Sales Tax Increase In Central Virginia Region Beginning Oct 1 2020 Virginia Tax

Virginia Estate Tax Everything You Need To Know Smartasset

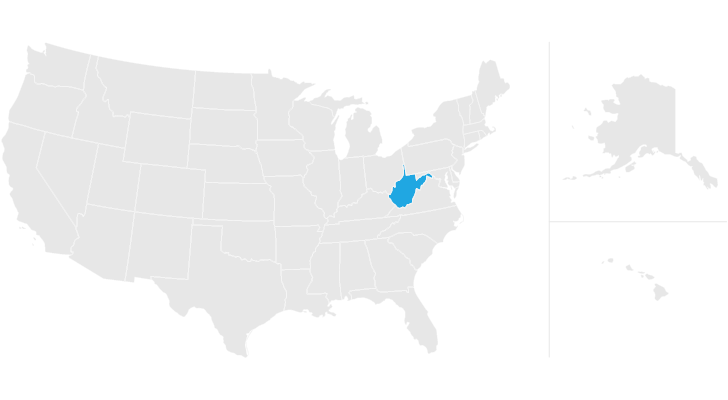

West Virginia Estate Tax Everything You Need To Know Smartasset

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Virginia Estate Tax Everything You Need To Know Smartasset

Legacy Assurance Plan Avoid Probate Probate Personal Injury Estate Planning Checklist

Virginia Estate Tax Everything You Need To Know Smartasset

Thinking About Moving These States Have The Lowest Property Taxes Property Tax Estate Tax Tax

Virginia Dpb Frequently Asked Questions

Virginia Retirement Tax Friendliness Smartasset

Regardless Of The Probate Court Or Law Enforcement S Actions You May Also Have Grounds For A Civil Lawsuit Against The Exe Probate Civil Lawsuit Estate Lawyer

The 10 Happiest States In America States In America Wyoming America

West Virginia State Seal Of West Virginia Zazzle Com West Virginia West Virginia History Virginia

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Nightlife Travel

Retired Residents Of West Virginia Senior Care Marketing Solution Digital Marketing Agency